Price Analysis

Find the right pricing with our profound market research expertise

Here are the most prominent methods to find the right pricing.

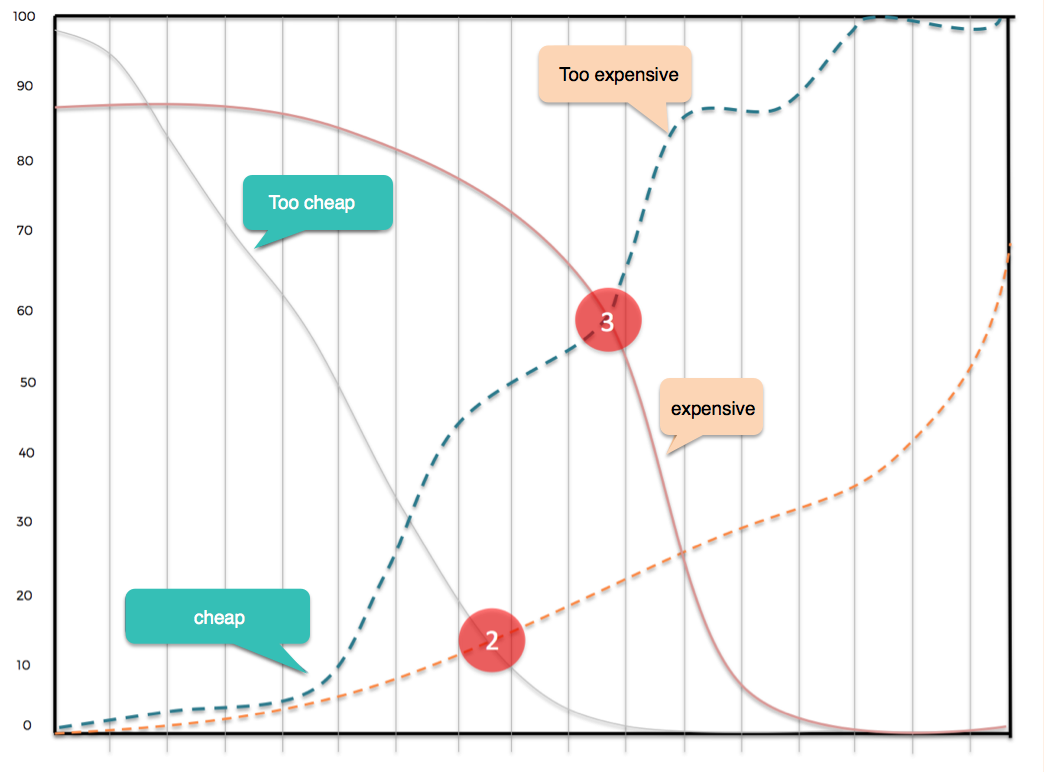

Van Westendorp's Price Sensitivity Meter (PSM)

Peter Van Westendorp was responsible for a well-known procedure to determine price readiness. Van Westendorp answers the two questions:

- What is the maximum price consumers would pay for a product?

- How high can a price be for the product to still be bought?

For the analysis, test persons are asked four questions:

- At what price would the product be too expensive that you would not buy it? (too expensive)

- At what price would you consider the product expensive but still be willing to buy it? (expensive)

- At what price would you consider it cheap so that you get good value for your money? (Cheap)

- What price would be too low for you to expect poor quality and not buy the product? (too cheap)

The intersection of the graphs of „not expensive“ and „not favorable“ is called the point of maximum price difference. At this point, the exact same number of consumers find the price either „expensive“ or „cheap“. This is where the price comes in best in the perception of consumers. As a downside, Van Westendorp’s meter does not adress product characteristics, as it purely deals with prices.

How do I optimize my Companies Price Demand Function?

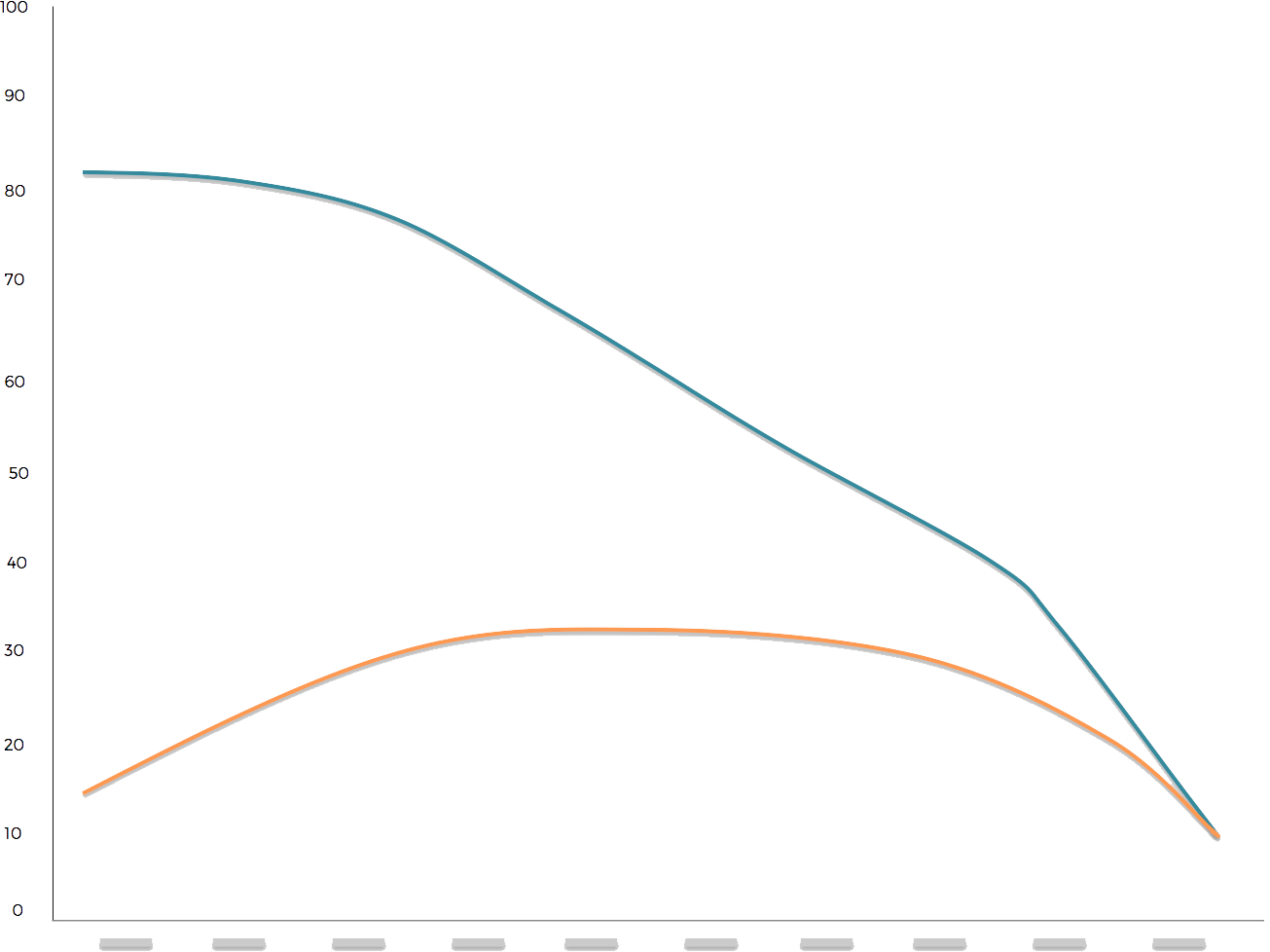

Gabor Granger Method

The popular method to explore the relationship between price and sales was developed by Andre Garbor and Clive Granger. Respondents indicate the probability with which they would buy a product at a number of defined price points. Throughout the entire sample, the price point information is cumulated and a price demand function is defined. Now the turnover can be calculated for each price. However, the Gabor-Granger method ignores the influence of competitor products and prices. Thus, it is best suited for product innovations or for products that are less exposed to competition. Conjoint analysis offer a solution to overcome this downside: via simulation certain product characteristics such as packaging design, quality perception, smell, haptics and price are compared and evaluated by the survey participants.

We create interactive dashboards for you to view results of various surveys simultaneously and in real-time.

Data Collection

You invite participants to your survey yourself or we recruit your target group via our Online Access Panel.

Through our panel we can provide survey participants in over 15 countries.

Through our partner network, we have access to survey participants from over 100 countries.

Concept

We specify the questions for your market research project and provide questionnaire templates or develop a bespoke questionnaire for your research project.

We help you to define your specific target group.

Reporting

Get real-time results through our online reporting. Create, share and send reports.

Our Customer Success Team carries out in-depth analyses with your data and prepares meaningful reports in PowerPoint or any other format.